OR 250-14 2010-2026 free printable template

Show details

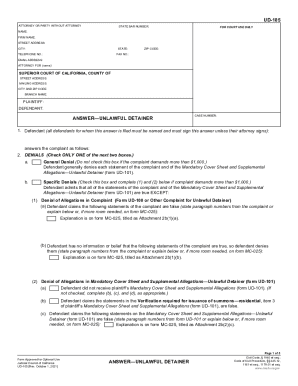

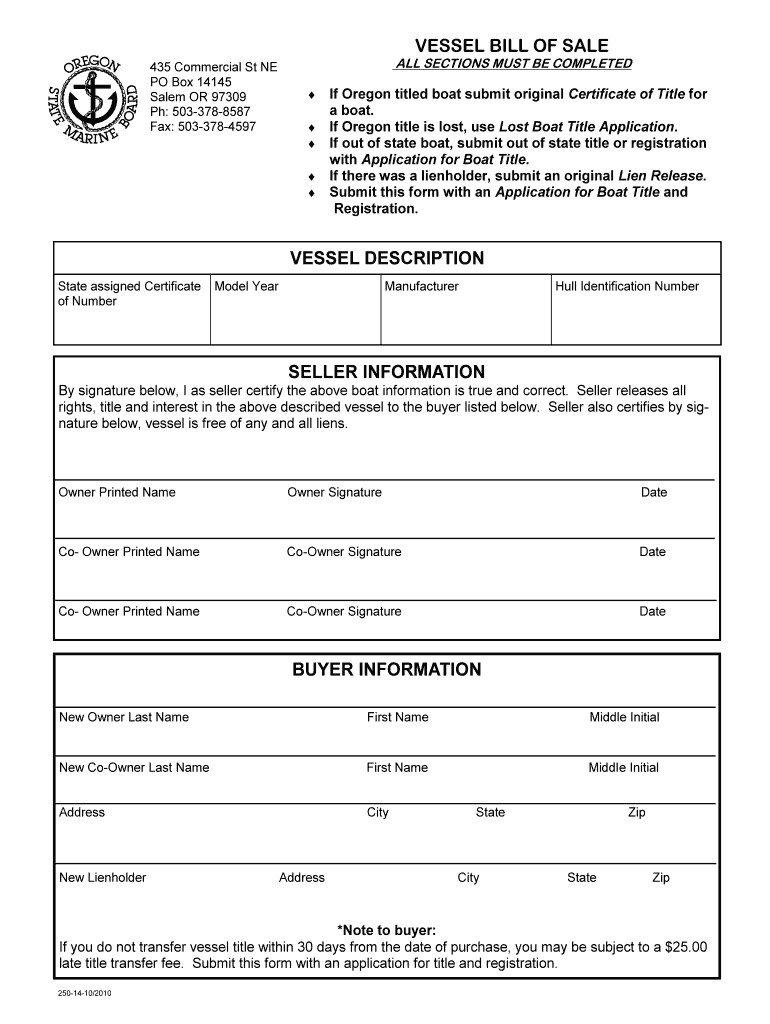

435 Commercial St NE PO Box 14145 Salem OR 97309 pH: 503-378-8587 Fax: 503-378-4597 ALL SECTIONS MUST BE COMPLETED VESSEL BILL OF SALE If Oregon titled boat submit original Certificate of Title for

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign oregon marine board bill of sale form

Edit your boat bill of sale oregon form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oregon boat bill sale form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bill of sale form boat online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit oregon state marine board bill of sale form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oregon bill of sale boat form

How to fill out OR 250-14

01

Obtain the OR 250-14 form from the appropriate regulatory agency or their website.

02

Begin by filling in your personal information including your name, address, and contact details.

03

Provide the date of submission at the top of the form.

04

Clearly indicate the purpose of the application in the designated section.

05

If applicable, fill out any sections related to prior permits or registrations.

06

Attach any required documentation or supporting evidence as specified in the instructions.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the form via the specified method (online, by mail, in-person) as directed.

Who needs OR 250-14?

01

Individuals or businesses seeking to obtain a specific regulatory permit.

02

Professionals requiring verification of compliance with local laws and regulations.

03

Entities involved in activities that require formal authorization by government agencies.

Fill

how to create a bill of sale for a boat

: Try Risk Free

People Also Ask about vessel bill of sale templates

How do I change my address with Oregon Dept of Revenue?

(a) “In writing” means a letter written to the department, a completed Form 150-800-738 Change of Address/Name, or a completed Form 150-211-156 Oregon Combined Payroll Tax Business Change in Status submitted to the department by the taxpayer or the taxpayer's authorized representative.

How do I contact the Oregon Department of Revenue?

Contact Us Mailing Addresses. Regional Offices. Phone: 503-378-4988 or 800-356-4222.

How do I change my address with the Oregon Department of Revenue?

(a) “In writing” means a letter written to the department, a completed Form 150-800-738 Change of Address/Name, or a completed Form 150-211-156 Oregon Combined Payroll Tax Business Change in Status submitted to the department by the taxpayer or the taxpayer's authorized representative.

What if I put the wrong address on my tax return?

What if I accidentally put the wrong address on my tax return? If you file your return with the wrong address, that can't really be undone. You'll need to contact the IRS directly to update your address (you can use their toll-free number: 1-800-829-1040).

How do I change my address on my taxes?

To change your address with the IRS, you may complete a Form 8822, Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns) and/or a Form 8822-B, Change of Address or Responsible Party — Business and send them to the address shown on the forms.

Can I make payments on my Oregon state taxes?

We offer payment plans up to 36 months, visit Revenue Online to set up a payment plan . If you are unable to set up a payment plan using Revenue Online, call us. If your account has been assigned to a private collection agency, contact them to discuss payments or to set up a payment plan.

What is Salem Oregon state tax?

The minimum combined 2023 sales tax rate for Salem, Oregon is 0%. This is the total of state, county and city sales tax rates. The Oregon sales tax rate is currently 0%. The County sales tax rate is 0%.

How do I set up a tax payment plan in Oregon?

We offer payment plans up to 36 months, visit Revenue Online to set up a payment plan . If you are unable to set up a payment plan using Revenue Online, call us. If your account has been assigned to a private collection agency, contact them to discuss payments or to set up a payment plan.

What form do I use for part year resident Oregon?

Part-year residents Use Form OR-40-P if any of the following are true: You're a part-year resident who isn't filing a joint return. You're married and filing a joint return, and you and your spouse are part-year Oregon residents, or one spouse is a full-year Oregon resident and the other is a part-year resident.

Who do I write the check to for Oregon state taxes?

Make your check, money order, or cashier's check pay- able to the Oregon Department of Revenue. Write “Form OR-40-V,” your daytime phone, the last four digits of your Social Security number (SSN) or individual taxpayer iden- tification number (ITIN), and the tax year on the payment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute boat bill of sale form online?

pdfFiller makes it easy to finish and sign bill of sale for a boat online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I complete how to write a boat bill of sale on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your form 150 211 156, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out oregon form 150 211 156 on an Android device?

On Android, use the pdfFiller mobile app to finish your OR 250-14. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is OR 250-14?

OR 250-14 is a form used by the Oregon Department of Revenue for reporting certain tax information related to Oregon state taxes.

Who is required to file OR 250-14?

Individuals and businesses that have specific tax obligations or transactions that pertain to Oregon state taxes are required to file OR 250-14.

How to fill out OR 250-14?

To fill out OR 250-14, taxpayers need to provide their personal or business information, report income, deductions, and any relevant tax credits, and follow the instructions provided in the form.

What is the purpose of OR 250-14?

The purpose of OR 250-14 is to collect information for tax assessment and compliance purposes, ensuring that the state can accurately gauge tax liabilities and collect revenue.

What information must be reported on OR 250-14?

Information that must be reported on OR 250-14 includes identification details, income amounts, deductions claimed, tax credits, and any other relevant financial data related to tax obligations.

Fill out your OR 250-14 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR 250-14 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.